It is a late snow day in Northern Virginia. It is not only the unusual cold weather in Spring, it is also the unusual low inventory in housing market in Northern Virginia area, particularly Fairfax County, the most populous county in the state of Virginia. This county of Fairfax is a preferred destination for many thanks to her vicinity to Washington DC, her high quality of transportation, her famous and reputable school system, and her quality of life.

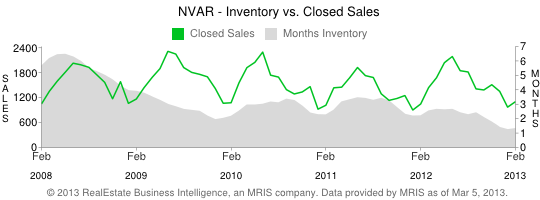

This morning, I ran my MLS search and found 13 single family homes for sale below $400,000 in the jurisdiction of Fairfax County (which has more than 1 million residents). And, even worse, only 1 home showed up as Active when I reduced the price to below $350,000. RBIntel reported in February that Northern Virginia area has slightly higher than 1 month of inventory (where a balanced market is about 6 months of inventory).

Now, this is where the rubber hits the road: in the hype of the first generation iPhones hit the market. Do you remember what happened? People are lining up in front of Apple stores for hours if not days because they know that there wouldn’t be many and they might not get one. That is the housing market right now. I am a Realtor ®, so you may think that I am exaggerating it. You should see this for yourself by observing your neighbor’s open house. You will see no less than 20~30 people coming through, and you maybe agitated with people parking in your spots or even in your driveway in some instances. Everyday, I am taking my clients/home buyers to see houses and we experience multiple offers every time we decided to put an offer on a house. Many of our buyers are first time home buyers with less than 20% down payment. When it comes to multiple offers situation, we easily lose out to those who have more than 20% down. Some even waive appraisal contingency – which I strongly disagree with because the buyer is being set up for either law suit or financial burden to make up for the difference of the sales price and the appraised value. When a Realtor® advised his/her clients to waive this appraisal contingency, he/she should be aware and make clients aware of the adverse consequences.

The good news about this agitation of yours is this market does help the increase in value of your house. When your neighbor sold his/her house for higher, it will just be great help to your home value. Yet, does it mean you will get the same or higher price than your neighbor’s house? That is when my expertise comes in to play (I am a Realtor®, remember? ;-)) My friends/clients who couldn’t sell their houses in 2008, 2009 started to call me to get their houses evaluated. Many of them are getting their houses ready for the market as we speak. It is going to be an exciting year for real estate this year. And, it will definitely help the whole economy as well.

This does not mean a lot if you are not looking for a home to buy, or you want to change your house but it will mean a lot if you share this with those who are in the process of doing so. Please feel free to do so.